3rd grade is too late to start thinking about saving for college...

- Temeka Easter Rice

- Oct 12, 2020

- 7 min read

I opened 529 college savings plans for my kids, Taylor & Adrian before they started preschool. I opened my son's account before he made his debut in this world. Financial literacy and higher education are two of my passions, so opening 529 college savings plans made sense.

Here are some additional reasons I started 529 plans. Let me disclose two critical facts: 1) I sold 529 state-sponsored college savings plans for six years, and 2) I am not providing tax or investing advice. Please reach out to your tax and investment professional for additional information.

Taylor and Adrian were featured in advertising for the Missouri MOST 529 College Savings Plan back in 2007. At this moment, I can't put my hands on any of the collateral but here are a few images from their photoshoot.

I am sharing my experiences as a mom of two future college graduates. As I completed the FAFSA and CSS Profile this weekend for my daughter, I realized I wanted to share this valuable information with you. Feel free to ask questions in the comment!

Let’s start with some basics: There are two types of 529 plans: Savings or Pre-Paid. My article focuses on savings plans. A saving plan can be direct or advisor-sold. Your contributions are made with after-tax money. And, your earnings grow free from federal and state taxes as long as you use the money for a qualified education expense (we’ll get into that a little later). And, your home state may provide additional tax benefits.

Throughout the post, I cite College Savings Plan Network which is comprised of state treasurers and others in the college savings place. It’s a good source of information on 529 plans.

Start with what you have. Increase when you can.

When I first started, it was a stretch to save $15 per pay period per child. Diapers, formula, and childcare as a recent college graduate were expensive. I sacrificed and started at $15. My great-aunt would hand me a crisp $5 bill every two weeks, so I increased my automatic contribution to $20.

Each year, I increased the amount by $5 per kid per pay period until I was able to jump to $150 per pay period per kid.

I'd like to tell you I was consistent during times of rain and shine; however, the reality is that as a single parent of two kids, I hit a rough patch or two and was unable to contribute. Once I had to cash out their accounts and start all over (gasp). Look, life happens.

The easiest thing to do is have your contribution come directly out of your paycheck automatically, and you will never miss the funds. Many 529 plans allow you to start with as little as $15 from your paycheck.

If it's too daunting to consider starting an account for multiple kids, just create an account for one child. The important thing is to get started.

If education is a family value, consider 529 plans

I've met people who say, "my kids might not go to college." And, I can't convince you of anything different. Nor do I want to because we're all individuals with our own unique experiences and value that make us unique. I can only tell you about my experiences.

I do know that college isn't for everyone. And, there are great careers for those who do not attend college. My dad and brother both retired after 20-year careers with the United States Navy and Army, respectively.

Since my kids were little, the word college has been a part of their vernacular. My kids have visited and toured college campuses since they could walk. They've attended sorority meetings and summer camps at colleges and universities in the states and abroad. "What college do you want to attend?" and "What is your favorite color?" were asked frequently. If my daughter said she wanted to be a firefighter, I'd tell her officers often have two years of college. If my son said he wanted to open a business, I'd say, "good for you, but mom needs you to take one accounting course, so you know how to count your money." The expectation has always been college in my home.

I can transfer the money to another child for their undergraduate or graduate expenses. Or transfer it to me or my grandkids. I'd have options if one of them didn't go to college, and I would not lose any of my funds.

In addition to college, trade school, tech schools, and study abroad programs, you can also use 529 college savings plans for K-12 expenses.

Read more on collegesavings.org: What to do if my child doesn't go to college?

Tax deductions and credits make 529 college savings plans a no brainer

I opened 529 accounts with Virginia, Missouri, and Indiana.

We lived in Missouri in 2006 and the state offered an $8,000 tax deduction for a single taxpayer ($16,000 for married filing jointly). So, if I contributed $7,000, I could deduct $7,000 from my adjusted gross income.

Temeka working 529 events in Nevada and Missouri!

When we moved to Indiana, the deal was even sweeter with a 20% tax credit on your contribution up to $1,000. If I contributed $5,000, I would receive a $1,000 credit on my taxes (lowering my tax liability). I tried to max it out each year that I lived in Indiana.

I still have an Indiana account because you have to pay back the credit if you move. We now live in Delaware, and I contribute to my Virginia 529 accounts for my kiddos. Virginia was the very first plan I opened because I am a fan of American Funds. Since my current state doesn't offer a state tax deduction or credit, I still chose the Virginia College America 529 College Savings Plan.

Typically, there are no residency requirements for the beneficiary (student) or the account owner when opening a 529 college savings plan. Always check with your home state first to see if there are state tax benefits. Many assume that your beneficiary has to go to school in that state because you have a particular state's program, but that's untrue.

Your earnings in the account grow free from federal and state taxes as long as you used it for a qualified expense.

What is a qualified expense: Tuition, room & board, books, fees, supplies at any two or four-year college or university in the country and some schools abroad. It also includes K-12 tuition.

Read more on collegesavings.org: https://www.collegesavings.org/common-529-questions/#question36

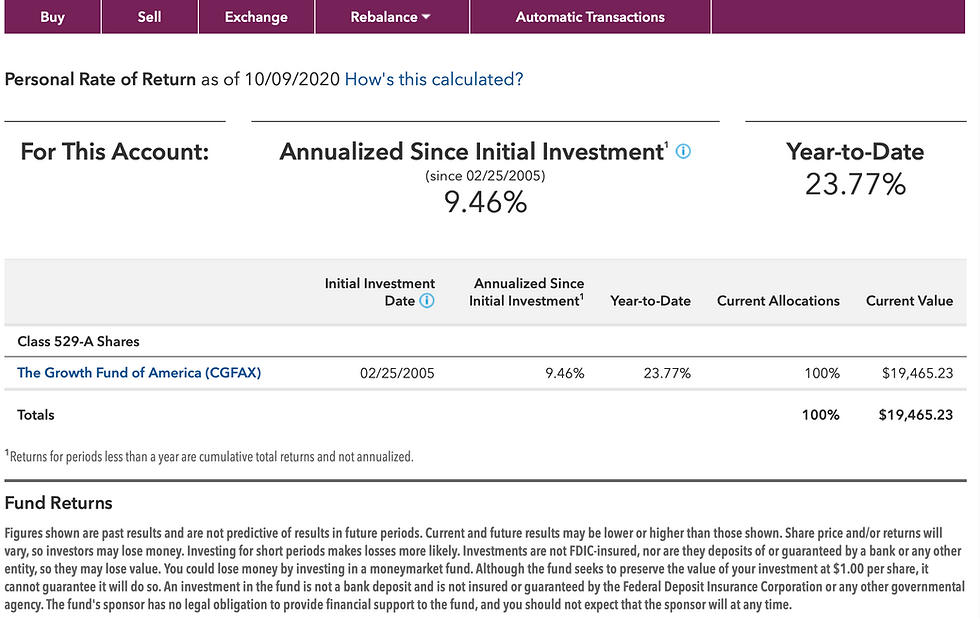

What might this look like? Here's a sample from one of my 529 accounts. You can see when the account was opened, the rate of return since the account was opened, and this year's rate of return. My performance does not indicate your performance or future performance, but I feel transparency helps us grow and learn.

Can you save too much in a 529 plan?

Maybe I don't move in the right circles. In all my years of working in the 529 space, I didn't meet anyone who saved too much money. Let's say my son gets an athletic scholarship; I can still use the funds to pay for books and room & board. Or a study abroad program.

I have seen families where a student received a full tuition and room & board scholarship, so they didn't need the funds for undergraduate school and instead used them for graduate school. If your child received a full academic scholarship for undergrad, there is a good chance they'll go on to get their MBA, MA, Ph.D., or other degrees.

Change the conversation from toys to investments

One of the most important things you can do is ask family and friends to contribute to your child's 529 college savings plans for birthdays and special events. We have to normalize college plans like we do toys and video games. The reality is my children didn't need any more toys when they were little.

I can't tell you that my family and friends embraced this or even contributed, but I started the conversation. And I'll be prepared for my future grandbabies. They will get a trip and a contribution to their 529 plan instead of a toy.

We have to normalize building investments in our families.

I was recently invited to a virtual baby shower celebration and was so excited to see a baby registry and an option to donate to a college savings plan

I'd rather save $1,000 than have to borrow $1,000

Two words: student loans.

I don't think I have to say anymore. If you have student loans, you know it's better to save $1,000 today than borrow $1,000 tomorrow.

Waiting until the last minute is not a good strategy

Here's one little fact I used to tell audiences when discussing 529 plans: By the time your child has reached the 3rd grade, you've lost ½ of your time to save for their college expenses.

Yep! 3rd grade. Your precious 3rd grader is eight years old, and in another eight years, they will be off to college. And, we don't start thinking about how we're going to pay until high school. That's a short horizon. And, waiting until senior year can be disastrous.

At least once a year, I get a frantic call in the spring from a parent who can't afford the bill from their child's college. They are looking for scholarships and grants at the 11th hour. This story ends typically with the child coming home after the first year because the parents stretched to pay for that first year and then realize it's not possible to do this three more times.

Set realistic expectations

Yearly, I've shown Taylor and Adrian their statements each year and the gain/loss. Again, the goal is to normalize words like mutual funds, gains, and losses. I know we don't want to share how much money we make with our kids, but I share how much I can afford to contribute to their college education.

I cannot afford to go into debt for their college education because I still need to save for retirement. You can borrow for college but not your retirement. If you're not saving for your retirement, I strongly urge you to start today.

Now that Taylor is in her senior year, I've shared three things: 1) how much I will allow her to borrow, 2) how much I will borrow, and 3) how much cash I will contribute each year towards her college education.

I've also told her what I won't do. I will not do pay $40,000 per year for her to go to her dream school. That's $160,000. I lived at home during college and was responsible for my college education. It wasn't the "ideal" college experience, but it was what I could afford. I'm not allowing my child to finance four years of her life for the next 20 years. No matter how much she thinks, she knows at the ripe old age of 17.

I want the stars for my children but will not finance the moon to make it happen.

I've given her a head start with a decent 529 plan. And, they must play their part to obtain scholarships and accept wise advice. College planning is a family affair.

Have you started saving for your child's future education expenses? If so, why or why not?

Comments